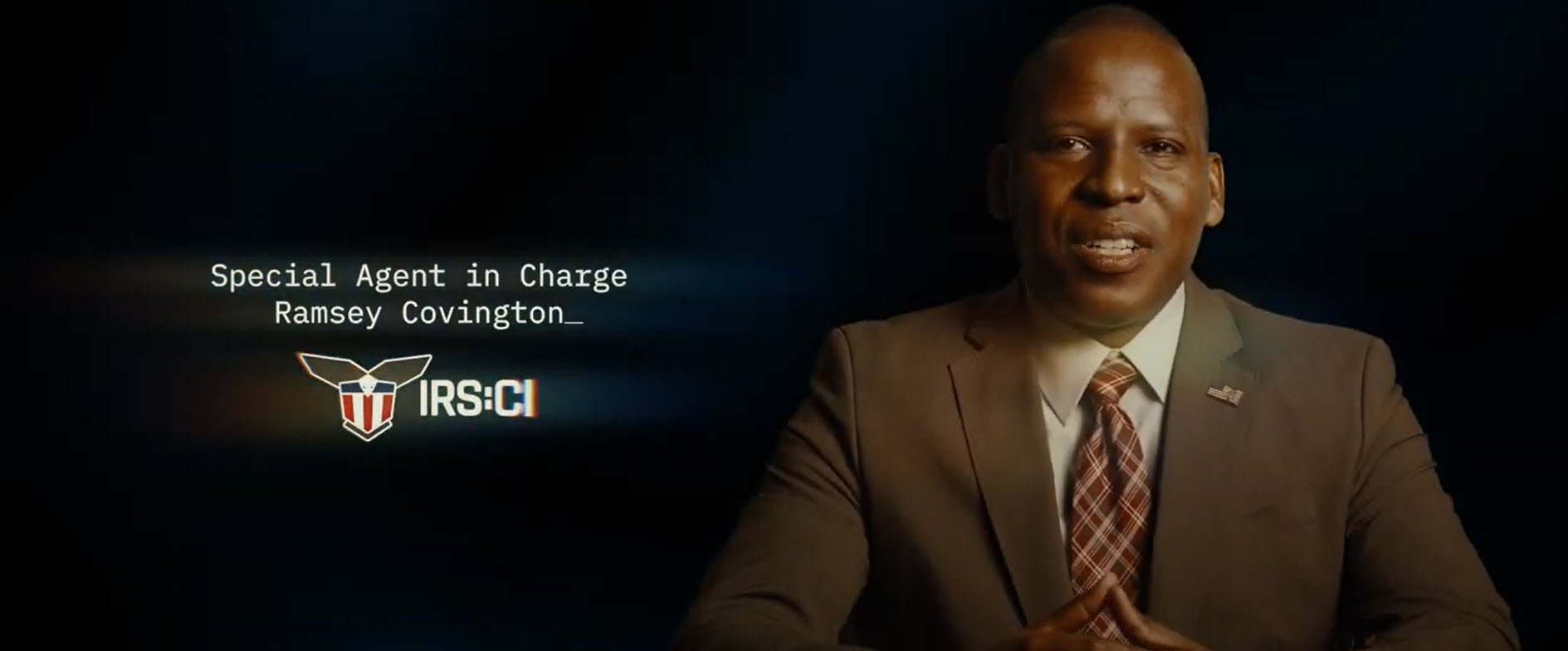

We're hiring Special Agents now!

IRS Criminal Investigation (CI) is the law enforcement branch of the IRS. Founded in 1919, the Intelligence Unit, as it was formerly known, was established to investigate tax fraud. In the present day, due to the taxable nature of all income, encompassing both legal and illegal sources, CI’s investigative scope extends broadly to cover a wide range of financial crimes. CI now has jurisdiction to investigate identify theft, political/public corruption, international tax fraud, domestic and international terrorism, as well as Bank Secrecy Act violations, among other potential criminal violations of the Internal Revenue Code, in a manner that fosters confidence in the tax system and compliance with the law.

In your role as a Special Agent, you’ll integrate your expertise in accounting with law enforcement proficiency to probe into tax and tax-related financial crimes. As sworn law enforcement officers, CI Special Agents excel in globally tracking funds and navigating through complex financial transactions. Moreover, given the specialized skills necessary to carry out intricate financial investigations, CI Special Agents are recognized as the world’s finest financial investigators within the Federal government.

CI Special Agents constitute a diverse workforce that reflects the broad spectrum of the taxpaying public we are dedicated to serving. To learn more about our mission and how to apply please visit the IRS Criminal Investigation Careers homepage.

To read our most current IRS Criminal Investigation Annual Reports, please click here.

Special Agent Job Qualifications

Please be aware that if you fail to meet any of the specified requirements listed below, you will not qualify for employment with CI.

- Hold U.S. Citizenship.

- Hold a current and valid driver’s license.

- Successfully clear a pre-employment drug screening.

- Successfully pass a pre-employment tax compliance screening.

- Successfully complete a pre-employment medical examination.

- Successfully complete a pre-employment Personnel Security Clearance.

- Successfully undergo a background check and criminal history record examination.

- Be at least 21 years old upon completion of the training academy and not exceed 37 years of age at the time of appointment.

- Qualify based on education, specialized experience, or a combination of the two.

- Be legally authorized to possess and carry a firearm.

- No affiliations with organizations aiming to overthrow the U.S. government.

Essential Duties

- Adhere to the utmost standards of conduct, particularly in upholding honesty and integrity.

- Commit to a minimum of 50 hours per week, encompassing irregular hours, and be available around the clock, including holidays and weekends.

- Sustain a level of physical fitness essential for proficiently responding to life-threatening situations during job-related tasks.

- Be prepared and capable of engaging in arrests, executing search warrants, and undertaking other hazardous assignments as required.

- Possess and be ready to deploy a firearm; must be prepared to safeguard oneself or others from physical threats at any moment without prior notice, employing firearms in situations posing serious threat to life; must be willing to utilize force, including lethal force, if necessary.

Physical Fitness Program

All applicants must clear a medical screening and once hired, must also undergo an annual fitness assessment per IRS CI Directive No. 5.

- Proper physical fitness conditioning is essential for a Special Agent to meet the physical demands of their law enforcement duties. The primary intent of CI’s Physical Fitness Program (PFP) is to assist agents with improving and maintaining their fitness level, helping them to meet the physical demands of the job.

- CI will maintain and support the PFP for all CI Special Agents.

- Part 1 – mandates an annual medical screening consisting of a Health History Questionnaire (HHQ), height, weight, blood work for a lipid profile and glucose screening, blood pressure, a baseline Electrocardiogram (EKG) followed by an EKG every 5 years beginning at age 40, blood lead screening, and an audiogram.

- Part 2 – mandates Special Agent participation in annual fitness assessments of flexibility, strength, and aerobic capabilities.

- Part 3 - strongly encourages Special Agents to voluntarily engage in health and fitness activities that are approved as part of CI’s PFP. Physical fitness coordinators are available to provide guidance for a fitness program.

- Every Special Agent is required to partake in the yearly PFP assessment to guarantee their capacity to respond to job-related situations safely and effectively. The PFP assessment consists of four core components, each timed with a designated rest period between each component.

- Run: Timed 1.5-mile run

- Push-ups: Timed maximum number of continuous push-ups

- Sit-ups: Timed maximum number of continuous sit-ups

- Sit and Reach: Assessment to evaluate maximum flexibility

About the Application Process

Step 1: Identify and submit a job application through USAJOBS.gov. Examine the qualification prerequisites, answer eligibility queries, and provide all required supporting documents, such as resumes, transcripts, etc.

Step 2: Application assessment is conducted. The details you provide and accompanying documentation are reviewed to verify your eligibility to progress in the hiring process. This ensures that your submitted documentation aligns with the qualification’s requirements for the position.

Step 3: Panel Interview. If chosen to proceed in the application process, a panel of senior management officials will conduct the panel interview.

Step 4: Conditional Job Offer. Following the interview, if you are recommended for employment consideration, a CI Human Resources Specialist will conduct a final qualifications review of your application. Upon confirmation, you will receive a tentative job offer (TJO) via email. This offer will specify the assigned Post of Duty (POD), provide instructions on the next steps in the process, and necessitate your response by the listed due date.

Step 5: Pre-Screen Process. A thorough background investigation, verification of tax compliance, fingerprinting, credit examination, medical evaluation, and drug screening will be completed. As part of the medical evaluation, a section of the health history questionnaire specifically related to fitness contains a certification from the special agent tentative selectees about their ability to perform sit-ups, push-ups/upper body exercise, 1.5-mile run (vigorous exercise) or 3 mile walk and sit and reach/flexibility program.

Step 6: Following the successful completion of the pre-screen process (subject to the finalization of the background investigation), an employment offer will be extended. This offer will include a start date and an anticipated date for attending required training at the Federal Law Enforcement Training Center (FLETC) in Glynco, GA.

Step 7: Induction and orientation. Upon beginning employment, a new Special Agent will report to their designated POD or FLETC as directed in their reporting instructions email.

Step 8: Required training. Discussed below, all newly appointed Special Agent Trainees (SAT) are required to attend Special Agent Basic Training (SABT) at FLETC. The training curriculum spans approximately 6.5 months and comprises three segments. Upon arrival at FLETC, all SATs will report for Pre-Basic Orientation Training Program (PB), Criminal Investigation Training Program (CITP) and Special Agent Investigative Training (SAIT). Upon successfully completing SAIT, a Special Agent will then report to their POD to commence their assigned duties.

Compensation and Benefits

As a federal employee, you will enjoy unmatched benefits. Please refer to our benefit programs for additional information.

Some of these benefits include:

- A salary commensurate with qualifications and assigned Post of Duty*.

- Initially, 13 days of annual leave; increasing to 19.5 days after 3 years and reaching 26 days after 15 years.

- 11 paid holidays.

Accrual of 13 sick leave days annually. - Medical, dental, vision, and life insurance options.

- Voluntary participation in the Thrift Savings Plan (TSP), a retirement contribution plan.

- Enrollment in the Federal Law Enforcement Retirement System.

*The Special Agent position sets itself apart by offering distinctive pay incentives that are not available in other IRS roles. For a comprehensive overview of Special Agent compensation, please click here.

New Agent Training

In support of the overall Internal Revenue Service and Criminal Investigation missions, the National Criminal Investigation Training Academy (NCITA) is dedicated to fostering the highest levels of professionalism and ethical behavior throughout the CI workforce. This is accomplished through planning, organizing, coordinating, and delivering a full range of world-class learning and educational products and programs that include basic training, advanced training, use of force training, leadership development training and international training. The overall goal of the various training programs that NCITA supports is to improve CI's individual and organizational workforce performance through the incorporation of the CI Guiding principles.

All new SATs will be scheduled to attend formal classroom training at the designated reporting date established by CI Human Resources and NCITA, consistent with the centralized hiring process.

SATs are continuously monitored, observed, and evaluated throughout CITP and SAIT by NCITA and FLETC staff.

A newly appointed Special Agent must satisfactorily complete the following recruit training program:

- Phase 1—Pre-Basic Orientation Training Program (PB)

- A pre-basic orientation is 1 day and conducted the day prior to the start of CITP. This orientation includes such topics as standards and expectations, CI organization, ethics and integrity, core values, diversity, among other necessary topics.

- Phase 2—Criminal Investigator Training Program (CITP)

- The CITP course is designed by FLETC. The course educates trainees in various Federal law enforcement skills, including the fundamentals of criminal law, constitutional law, the rules of evidence and criminal procedures, testifying practices, investigative techniques, vehicle operation, non-lethal control techniques, and firearms.

- Upon arrival at FLETC, SATs MUST be able to successfully perform and complete the Physical Performance Requirements (PPRs) of SABT. Failure to complete training due to a medical or physical condition present prior to arrival at FLETC may lead to removal from training, the Special Agent position, and the IRS.

- During the first week of CITP, trainees are required by FLETC to complete a Physical Efficiency Battery (PEB) which is administered by FLETC’s Physical Techniques Division.

- The PBRs which include, but are not limited to, completing a timed 1.5 mile/walk in under 18 minutes, maximum bench press, a continuous three minute period of running, the successful completion of the Illinois Agility test in under 20 seconds, maximum number of continuous sit-ups, use of rapid and coordinated body movements to control an adversary and/or defend against physical attacks, physical control of an adversary during takedowns and all restraint techniques, etc.

- Satisfactory completion of CITP is a prerequisite for SAIT. Unsatisfactory performance in CITP will disqualify the individual from further special agent training.

- The FLETC administered CITP phase of training lasts approximately 12 weeks.

- Phase 3—Special Agent Investigative Techniques (SAIT)

- During SAIT, students will learn how to investigate the specific violations of Federal law under CI’s jurisdiction. Students receive tax law training with an emphasis on criminal violations of the tax law.

- Satisfactory completion of SAIT is required to retain employment as a Special Agent.

- The CI administered SAIT phase of training last approximately 14 weeks.

- Upon successful completion of SABT, a graduation ceremony is held and SATs receive their official Special Agent badge, credentials, and firearm.

- Phase 4—On-the-Job Training (OJT)

- The purpose of the on-the-job training (OJT) program is to provide a newly trained Special Agent the opportunity to develop investigative skills by applying the knowledge learned in SABT while encountering the challenges present in a real-life situation. The Special Agent OJT program is designed to provide a new Special Agent meaningful work assignments and assistance toward reaching a professional level of competency as quickly and efficiently as possible.

- A newly appointed Special Agent should expect to be in OJT status for approximately 2 to 3 years.

Other Career Opportunities available within CI

CI presently maintains a strong workforce collaborating closely with our Special Agents. These highly valued employees offer support, guidance, and assistance in fulfilling our critically important tax mission. Broadly, these roles can be categorized into Investigative, Administrative, and Technical Staff, integral to every aspect of CI’s operations. Each of these professional staff categories contributes to advancing the missions of both Enterprise IRS and CI.

To learn more about these exciting professional staff opportunities, please click here.

All appointed non-agent CI employees will report to their designated PODs to commence their assigned duties but may be sent to the training academy at a future date to enhance their work skills.

Current CI Career Opportunities

To view all current announcements, please click here.

Discover more about current CI job openings by participating in one of our virtual information sessions. View the full schedule of events by clicking here.

Connect with a Local Recruiter

For inquiries about a career with CI, including the Special Agent position, please reach out to a local recruiter in your region. Click here for contact information.

Featured Jobs

Learn more about upcoming IRS Events

@RecruitmentIRS on X

¿Habla español? #IRS is #NowHiring Intake Technician (Bilingual-Spanish) in multiple locations. To apply for one of these bilingual positions or learn more about the job, visit https://t.co/wPQDqnLKn9 pic.twitter.com/9leH8w0MWo

— IRS Recruitment #IRSjobs (@RecruitmentIRS) December 27, 2024Apply before the new year arrives! The #IRS is seeking Tax Examining Clerk/Technicians in multiple locations. This announcement closes 12/31/2024! Apply now here: https://t.co/WdO2Wd7nSB See you soon #FutureIRS-employees! pic.twitter.com/9dY4Mrzcy5

— IRS Recruitment #IRSjobs (@RecruitmentIRS) December 27, 2024The #IRS is hiring Tax Examining Clerks / Technicians nationwide. There are many seats to be filled! Grab yours by applying now: https://t.co/RFWT7JUW7H pic.twitter.com/i7MONnrRbY

— IRS Recruitment #IRSjobs (@RecruitmentIRS) December 26, 2024